NorthWestern Energy

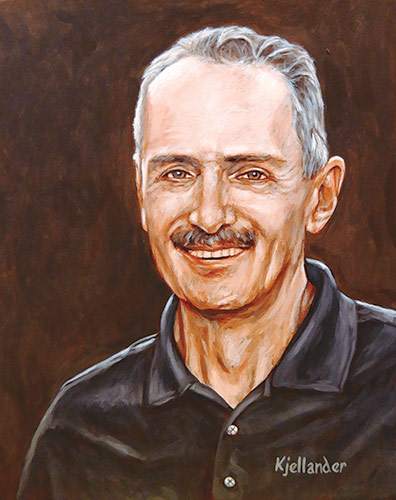

Bob Rowe is the retired CEO of NorthWestern Energy, also former Montana PSC Chair. Former NARUC President Paul Kjellander, also former Idaho PUC President, is Senior Advisor at Public Utilities Fortnightly.

Bob Rowe retired as CEO and a member of NorthWestern Energy's board of directors at the end of 2022. He led the utility over a fourteen-year period, an amazing length of time for any CEO.

Rowe in his tenure was pictured in these pages where he seemed most at home, usually outdoors, as part of a NorthWestern Energy team. Of course, that teamwork was only part of what made him a great leader, for he accomplished much during his time at the utility providing service to Montana, Nebraska, South Dakota, and Yellowstone National Park.

Rowe is also known for having been a Commissioner and Chair on the Montana PSC in his early career. So, it was fitting that he discussed his professional life with former NARUC and Idaho PUC President Paul Kjellander, now with Public Utilities Fortnightly. Enjoy this farewell.

PUF's Paul Kjellander: Your history with NorthWestern Energy involves deregulation, bankruptcy, and being a Commissioner at the Montana Public Service Commission.

Bob Rowe: I started with the Montana Commission in '93 and was focused on telecommunications, but the energy sector was going through supply deregulation. It was a significant area of interest in the west.

Take the Regional Review for example. Montana Power was successfully diversified into a range of adjacent businesses. Unfortunately, rather than managing risks, they doubled down on telecommunications investment and at the same time decided to support complete restructuring at the supply level.

That led to divestiture of the entire generating fleet in one sale and redeploying the proceeds in telecommunications, which was potentially the highest growth of their competitive businesses, but also the riskiest. At the Commission, we were challenged with managing through that, focused on customer protection, creating the rules, trying to engage in the western market.

The challenge was that the State and Montana Power made a bet-the-farm choice on divestiture rather than a more gradual approach to market opening, which would have allowed the larger customers direct market access or market-based tariffs.

At the same time, there was no organized western market. So, the other western states outside of California, which of course was large enough to create its own market, took a look at the supply deregulation alternative, and walked back from the precipice. In Montana, we held hands and jumped off the cliff. The challenge was, how do you make that work for customers?

Dealing with supply restructuring was challenge enough, but as Montana Power transitioned into being a telco, which ended up in a liquidation bankruptcy, NorthWestern Public Service came in, committed to the utility operation, and acquired the distribution system. I, at the time, was delighted to have a company come in that wanted to be in the utility business.

Ultimately, NorthWestern had its own challenges as a result of its aggressive diversification out of the regulated utility business that led them to doing the right thing, going into a reorganization bankruptcy in order to shed all of the nonregulated businesses. I helped lead the State of Montana's participation in that bankruptcy, with a focus on what kind of company we wanted to serve the State of Montana.

PUF: As a State Commissioner you played a significant role to help bring NorthWestern Energy out of bankruptcy. How important was that in charting a path forward for NorthWestern?

Bob Rowe: It was extremely important for the State of Montana, and for the company. The people in the utility operation were always committed to providing good utility service and that was key.

There were a couple of things going on at the same time, participating in the bankruptcy, trying to be sure that the company came out utility focused and financially strong.

Second, we, with full cooperation from NorthWestern, commissioned an infrastructure audit, electric and gas, and it came to be known as the Liberty Audit. Liberty Consulting led that audit. That became important later when I joined the company.

The third thing we did that the leadership at NorthWestern now periodically goes back and looks at is, the Commission was being approached by a variety of parties who said they would love to come in and acquire the system out of bankruptcy.

So, we put together a non-binding declaration statement of what we wanted to see in the company that served Montana, and that boiled down to a company that was financially sound given the need for investment; utility focused, obviously; community focused, customer focused, and operationally excellent.

There are parts of that statement that you can agree or disagree with, and there were some twists and turns of the document based on Commissioners' particular views, but fundamentally it still is a document that guides us. The document was focused on Montana, but we've taken those messages to heart, service-territory wide. That was a useful exercise and helped everyone focus.

One of the dangers in policy or regulatory roles is you end up potentially with too much of a focus on policy and not enough of a focus on the business of serving customers. Going through the bankruptcy process led me and others at the Commission to get focused on the operational side of utility service and an understanding of the financial requirements.

What do credit ratings agencies look for? What kind of equity investors do you want in a company? What are they looking for? How does regulatory policy or perception of regulatory risk affect credit ratings? How does it affect the nature of the parties who will buy utility stock and at what price?

PUF: Montana Power wanted deregulation and unfortunately got it, then NorthWestern Energy tried to right the ship but that left a tight situation. As Commissioner, you helped guide a path forward in Montana that set up guidelines for the service territory. In 2004, you're term-limited and start a consulting business.

Bob Rowe: During the consulting period, I was working with Mike Bellhoff, and Brad Williams, and we were focused on the telecom industry at an important time. We started doing consulting around strategy with NorthWestern not long before I was asked to join the company.

That was the first opportunity I had to do work in Montana. I had made a point of not working much directly in Montana for a period after leaving the Commission.

When I joined NorthWestern, it wasn't something I was looking for, and I had a real sense of loyalty to my partners, but it was an opportunity to serve the place I lived. By the way, it was very nice to be not in the public eye. That is to be appreciated.

But it was an opportunity to help do the work that I felt was important when I was at the Commission. At NorthWestern, we were focusing on customer service, infrastructure, and trying to move forward meeting expectations from stakeholders.

Although my background had been in Montana, I loved getting to know South Dakota and Nebraska as well.

PUF: You took the reins of NorthWestern Energy fourteen years ago, when it was a troubled utility. What were the biggest issues you had to resolve?

Bob Rowe: There are the soft issues and there are hard issues. On the soft side, I spent a lot of time inside the company and outside asking questions, listening to people.

My focus was on rebuilding trust with employees, whether they were originally with Montana Power Company or NorthWestern Public Service, and especially with the senior management team, many of whom are still serving today. Rebuilding trust outside the company involved working with customers, policymakers, and community leaders.

In the financial area, we needed to move our credit ratings up and to improve the nature of equity ownership. We were owned coming out of bankruptcy primarily by short-term investors. But even when I joined, the largest investor was a hedge fund. Hedge funds are important, but the long-term view of utility operations and investment is best aligned with long-term institutional investors.

At that time, we only had two equity analysts covering us, partly because of coming out of bankruptcy, when there was an expectation that the company wasn't going to be around for very long independently.

There was a lot of work to do on the financial side. I want to highlight Brian Bird who was then CFO, and is the incoming CEO. He joined the company during the bankruptcy, to help lead the company out of bankruptcy. The finance department was extremely important, including budgeting, establishing good internal controls and accountability, and working with ratings agencies and equity owners.

Operationally, the Liberty Audit that we commissioned when I was at the Commission, became a template for our infrastructure work. One of the first things we did was create a stakeholder group to focus on the electric and gas distribution systems.

I like good stakeholder processes designed to lead to actionable outcomes. In this case, the outcome was the Distribution System Infrastructure Plan, or DSIP. A lot of good work inside the company was led by our distribution team, Curt Pohl our Vice President for Distribution, John Carmody leading asset management, and with engagement all the way out into the field.

That was the foundation for several iterations of infrastructure planning leading up to the present day, including work in Nebraska and South Dakota.

On the generation side, in South Dakota we'd always been vertically integrated and as a result, the company was able to stay out of general rate cases for thirty-four years. There was capital investment made in the system that was fully depreciated before we finally did go in for a rate case. It was an incredibly stable and constructive situation. We took a similar approach in South Dakota in terms of supporting local economic development, focusing on the infrastructure, building relations.

Montana required more attention because Montana had gone through deregulation, divestiture, and liquidation of Montana Power Company.

PUF: With the Montana service territory, you had to end deregulation, not something that had been done before. You had to acquire generation and turn it back into a vertically integrated utility.

Bob Rowe: There was important legislation in Montana before I joined NorthWestern that allowed for approval of generation additions, either construction or purchase, and that was a key to restoring the ability to serve Montana.

The State of Montana had at that point concluded that at the retail customer level, supply deregulation had not worked. That was the correct conclusion.

On the generation side, the only nonutility asset that NorthWestern owned by the time they managed to exit everything else through bankruptcy was two hundred twenty-two megawatts in Colstrip Unit 4, that had never been in rate base in Montana. The ownership structure was extremely complicated.

The company managed to put together a saleable interest and then sold it, but with the right for the Montana Commission to review it before the sale closed. That was pending when I joined the company in 2008.

Ultimately the Montana Commission decided to put that portion of Colstrip Unit 4 into rate base. That was the first generation asset we owned in Montana, dedicated to serving our customers.

We next built a gas plant intended as much as a transmission resource as a supply resource, to keep the system stable, integrating all the wind that was coming on to the system. That was a key addition in 2011.

Then we acquired the hydro system of eleven dams that had been sold by Montana Power to PPL. That is the crown jewel of our Montana supply portfolio.

The dams were the most cost-effective resource alternative, but the purchase was based only on the value of the energy. In addition to the simple energy, there were also the system benefits of being able to integrate those assets into a larger system of transmission and generation resources, to provide grid level services.

We also didn't factor in the value of additional investment in the dams. We've been able to add generation at the existing dams that provides further value to our customers.

Winter weather over the last month provides a great example of the value of a diverse portfolio. We are dual peaking.

Our summer and winter peaks usually occur during high pressure and can last days. Wind isn't producing energy in high pressure. Wind is an energy resource, but by itself contributes very little to meeting capacity needs.

It was important for us to have traditional resources, such as our interest in Colstrip and the hydro system to help get our customers through the last month. The same is true in summer peaks.

We're also more dependent on the market than we should be. Think of the resources we have as providing an energy base, but we are still more dependent on the capacity market than virtually anyone else in the west. There are lots of straws in the same western drink.

That leads to questions about transmission availability, as well as what's going on in the regional supply market. Right now, one of the company's areas of focus is addressing the infrastructure capacity situation on the network, but also long-term reducing customers' exposure to the regional market.

PUF: What are you leaving your successor?

Bob Rowe: The team that leads NorthWestern Energy is tremendous, starting with incoming CEO Brian Bird. We talk a lot about task and team. Each one is great at their jobs, they are leaders of good teams, and they're good team members.

They all take a big picture view of the company, as opposed to simply advocating for their piece of it. That's key. There's a shared vision of what the company needs to do in order to meet the needs of customers and communities over the long term.

The culture of the company is in good shape but can become better. I expect that will be a focus. I expect to see a focus on the capacity of the infrastructure that serves our customers, that is the physical capacity of the electric and natural gas delivery systems, as well as supply.

I expect to see a continued technology journey. Some of that is invisible to customers, but it's going to become more visible as we're able to use the technology to serve customers the way they want to be served — to surprise and delight them. The people leading this effort are doing exciting and creative work.

PUF: Your board of directors renamed one of the utility's dams the Rowe Dam at Mystic Lake. What's next for you?

Bob Rowe: I was beyond shocked that happened. Our board chair made the joke that he's used to saying, "damn Rowe," not "Rowe Dam."

In terms of what's next, I love this industry and I believe in its mission, so I want to stay involved. I don't know in what capacity. Both my wife Melanie and I are involved in a number of nonprofits and we're going to be putting a lot of time into that.

What I'm going to miss is the day-to-day working with people on things that matter. That was why I was eager to join NorthWestern to begin with, working with good people in a part of the country I love on things that matter.

Lead image: Linemen restoring a distribution line in a rural/remote section of NorthWestern Energy’s service territory. Painting by Paul Kjellander.

Category (Actual):

Department: