The CEO Power Forum: Not all utility CEOs are created equal...

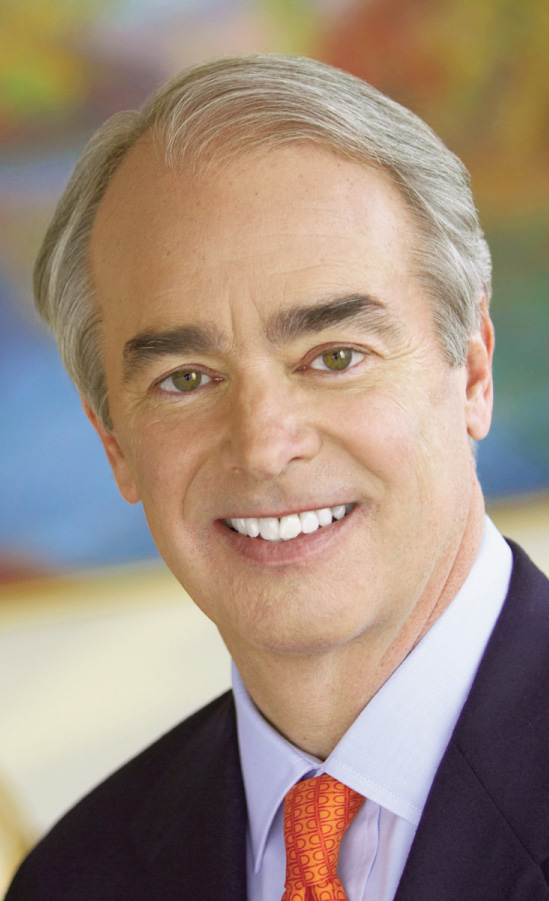

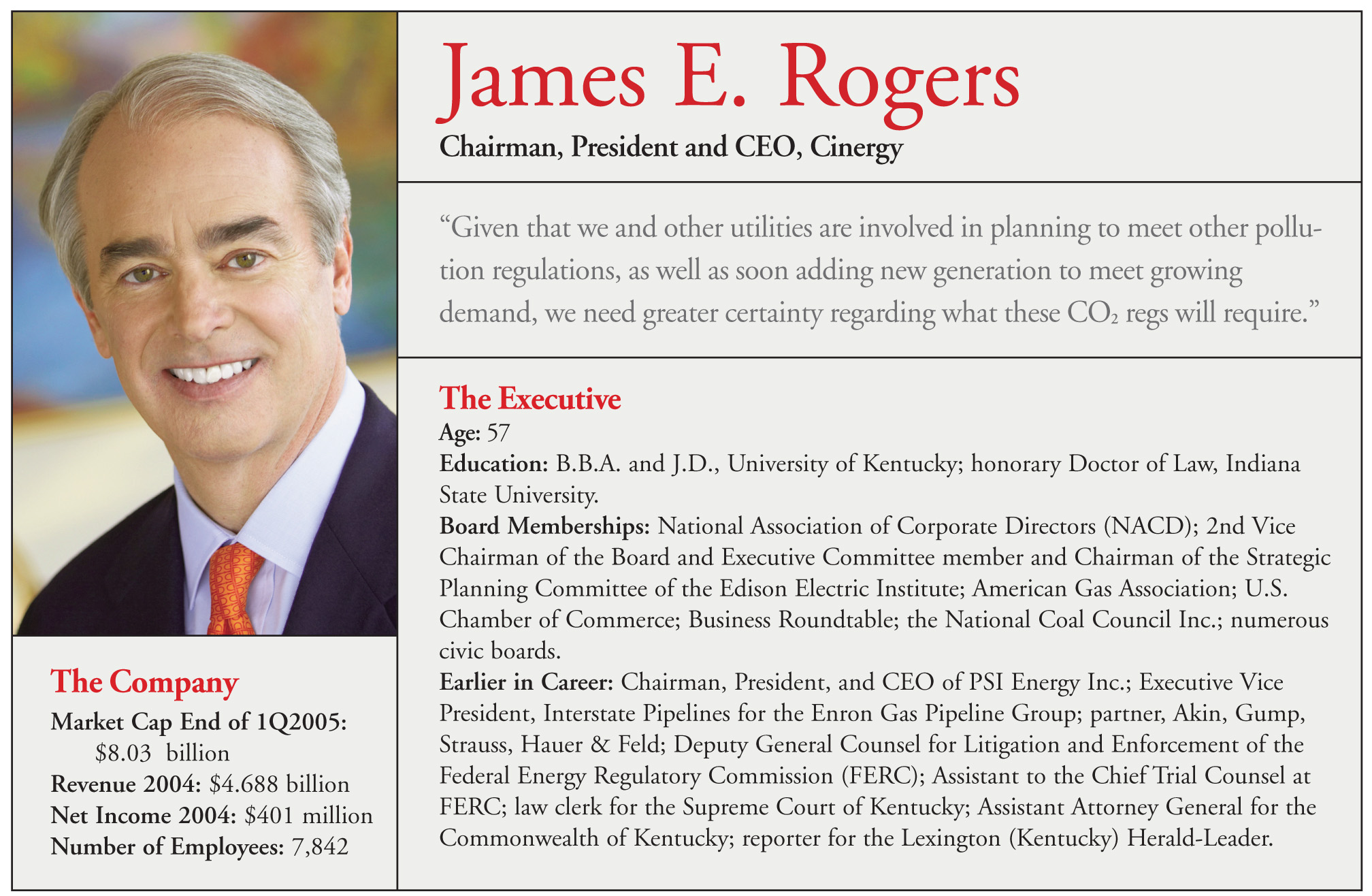

James E. Rogers

Chairman, President and CEO, Cinergy

"Given that we and other utilities are involved in planning to meet other pollution regulations, as well as soon adding new generation to meet growing demand, we need greater certainty regarding what these CO2 regs will require."

Public Utilities Fortnightly What has caused Cinergy to get involved in the global warming and sustainability issue?

James E. Rogers We accept the science of climate change as expressed by the National Academy of Science report made to President Bush in 2001-the earth is warming, it will likely continue to do so, and human action is contributing to this. We think it is a problem that will require some action. We'd celebrate if new evidence strong enough to prove this wasn't happening should appear, but the skeptics have been working on this since the early 1990s and have yet to defeat the theory. Unable to defeat it via the peer review process, the "no club" has taken to claiming the entire process has been corrupted by group think and the scramble for funds. In science, great status comes from disproving a generally accepted theory. We think this ethic is still strong enough that if climate change could be disproved, it would be.

Fortnightly Why is Cinergy, a company that uses significant amounts of coal to power its electric plants, engaging in a discussing on greenhouse-gas emissions regulation?

Rogers We think Congress will eventually pass laws to regulate CO2. If you read the signposts, action is imminent. There have been state actions that require reporting and capping of greenhouse-gas emissions. There has been an increase in support in the U.S. Senate for global-warming concerns. Add to that the approval of the Kyoto Protocol by 38 industrial nations, and a growing number of shareholders are expressing interest in companies quantifying the risks associated with greenhouse-gas emissions. Not to mention, we have seen the development of CO2 and greenhouse-gas emissions trading markets in Europe and the United States and the increased media attention on the issue of global warming.

Given that we and other utilities are involved in planning to meet other pollution regulations, as well as soon adding new generation to meet growing demand, we need greater certainty regarding what these CO2 regs will require. Sooner would be better than later because of the massive amounts of investment capital soon to be deployed in new coal plants. When we make such large investments (about $1 billion for a coal plant), utilities and state regulators have to look at prices going out more than 20 years for fuel, allowances for NOx, maybe mercury, and electricity prices when we decide whether or not to invest. If and when CO2 hits, that will be another input to companies' financial models. We are including some CO2 in our analysis as sensitivity runs, but it is very fuzzy now. The vital question is when, and how much. This is what we think needs to be resolved. There are a lot of conventional coal-fueled power plants on the drawing board now. Greater price certainty for CO2 would greatly increase the odds these would be clean-coal plants.

Fortnightly What do you see as the solution to climate change in the electricity sector- IGCC, DSM, renewables, LNG, nuclear?

Rogers Coal will be part of the solution. It is the most available and least expensive energy source available to us now. We're confident it will remain so, even after you factor in the future cost of CO2. This will require new technology to efficiently convert coal to electricity and then capture the resulting CO2 and put it into geologic formations similar to those that have held natural gas for millions of years. We think the best approach now is IGCC (integrated gasification combined-cycle), where coal is converted to a synthesis gas of hydrogen and carbon monoxide, then burned in a turbine to create electricity. Other technologies like ultra-supercritical (very high temperature and pressures) may also work, but they are not as far along the development timeline.

We're told IGCC and carbon capture and storage is a very plausible approach, but obviously it hasn't been commercially deployed because it isn't without cost. Proving this technology represents a massive public good, for consumers, coal people, and environmentalists. Therefore its development should be supported with public money. Cinergy would like to be a partner in moving this forward, and already has a site picked out in Indiana on top of what is supposedly a terrific geologic formation. We're working with GE and Bechtel to make this happen. This technology may be the best source for hydrogen too for power vehicles. This is terrific opportunity for coal.

Fortnightly What is your view on renewables and conservation? What role do you think it will play?

Rogers Renewables and conservation will play an important role in a low-carbon future, but they should be brought on board as it makes economic sense, not forced ahead of time by mandates. As an example, we purchase five hybrid vehicles from Ford and Toyota for our fleet to give our folks exposure to this technology. These are terrific vehicles, but when we determine the costs of the CO2 reductions they make it's on the order of $150/ton. The CO2 price needed to make an IGCC plant a good investment is between $25 and $40/ton. From a carbon point of view, IGCC is the better investment. Technology mandates, whether for renewables or hybrids, risks spending a lot of money on one technology before the less expensive alternatives have been exhausted.

Fortnightly What approach to global warming would you recommend to regulators and policymakers?

Rogers We would prefer that legislators keep the following in mind when dealing with this problem. The economy is highly dependent on low-cost, high-CO2 energy. Therefore, we have to develop policies that have the least economic impact. We don't want to be required to install a particular technology. We prefer a market-based solution like that used to address acid rain, based on a cap-and-trade of CO2. This is the least cost, most economically efficient way to deal with emissions. The last thing we want is a mandate to apply a particular fix. With a market-based approach, the emission just becomes part of the financial calculation and pollution goes down.

The path for CO2 has to be to slow, stop, and then reverse growth of emissions - you don't want to just slam your car in reverse while cruising down the highway at 65 miles per hour. Therefore, we like an approach that has received a lot of attention by some prominent economists at Resources for the Future and the Kennedy School of Government and the bipartisan National Energy Commission-mainly a cap-and-trade, with an escalating price cap during the early years of the program. This would make the emissions cap "soft," meaning it could be exceeded in the early years of the program. This is much more cost-effective, lowers the risk of economic shocks and political rollback, and in the long run achieves 90 percent of the reductions of a pure cap.

Fortnightly What is your view on administration efforts to deal with the global warming issue?

Rogers The administration is actually doing quite a lot. Voluntary programs like President Bush supports are a terrific start. We've pledged to reduce our emissions to 5 percent below our year-2000 level by 2010. These programs get companies to begin thinking about the problem without forcing premature action. Forward-looking firms have begun to act. A voluntary program though will only get reductions that probably should have been made anyway-small items with some profit potential because of energy savings. No one will make the big money investments needed to build an entirely new energy system that the climate change problem will ultimately require unless they have a CO2 price signal that makes this a profitable move.

The administration is also working to provide funding for new technology development, sort of priming the pump to give us a head start. These technologies will be further developed and then ready to be widely deployed once we are required to make significant reductions, which will happen eventually. It is unlikely though that these new technologies will be widely adopted outside of a CO2 control regime because they often can't compete with current generation technologies that are well understood and fairly reliable. The administration is also providing a good deal of funding for ongoing climate research, and they should be applauded for this too. People may not like some of what is happening, but they should be willing to provide credit where credit is due.

Fortnightly One of the chief complaints by those that oppose U.S. action on global warming is that China and India, two of the biggest contributors to climate change, are not talking of participating. What is your view of this criticism, and how could they participate?

Rogers China and India have to be brought on board. We must be able to source carbon offsets (or create reductions) from these countries where they will likely be less expensive because of efficiency differences in some sectors. We don't see them as barriers but as future markets to buy low-cost reductions and to sell the technology solutions that will be developed here in the United States. Harvard's Stavins suggests the key may be in a trigger mechanism where developing countries agree to binding commitments once GDP reached an agreed level. Alternatively, growth targets could be used whereby CO2 limits tighten if economic growth exceeds a target level and eased if it fails to meet target (acting as a sort of economic throttle while controlling emissions). Major developing countries must be participants, but they will not necessarily have the same targets until they achieve a certain level of wealth.

Fortnightly Some have been advocating a carbon tax proposal that would incorporate all fuels that impact climate change. Do you support such an initiative?

Rogers There is a hole in the federal budget big enough to drive a super-tanker through. Much of federal spending is for non-discretionary items like defense, Medicare, Social Security, and so on. The president wants to reform Social Security, including private accounts. This will create even more debt. There is also a real interest in simplifying the tax code. Some note that a consumption tax is less of an economic drag than an income tax. It's more efficient. If forced to choose between raising income tax rates or implementing a small consumption tax, which would be preferred, the consumption tax would cause less of an economic drag. So, there is a big need to raise revenues combined with a desire to reform taxes. A cap-and-trade on GHG would raise revenue. It would be the economic equivalent of a consumption tax on fossil fuels. This would slow imports of oil and force a more efficient use of coal and natural gas, migrating us to cleaner technologies. It would also likely cause less of a drag on the economy than if marginal income tax rates were raised. This may be an elaborate "political-science fiction" but wouldn't it be surprising if it weren't the environmentalists who resolved climate change, but fiscal conservatives?

Fortnightly Is broadband-over-power-lines a viable business? Do you really believe in the technology? How might it change the valuation of the company if it takes off?

Rogers We believe in the technology, but we're taking a go-slow and a low-profile approach to learn all we can from our initial deployment in some Cincinnati neighborhoods. Given the changing dynamics of the broadband industry and the number of competitors, we want to under-promise and eventually over-deliver.

Category (Actual):