The CEO Power Forum: Not all utility CEOs are created equal...

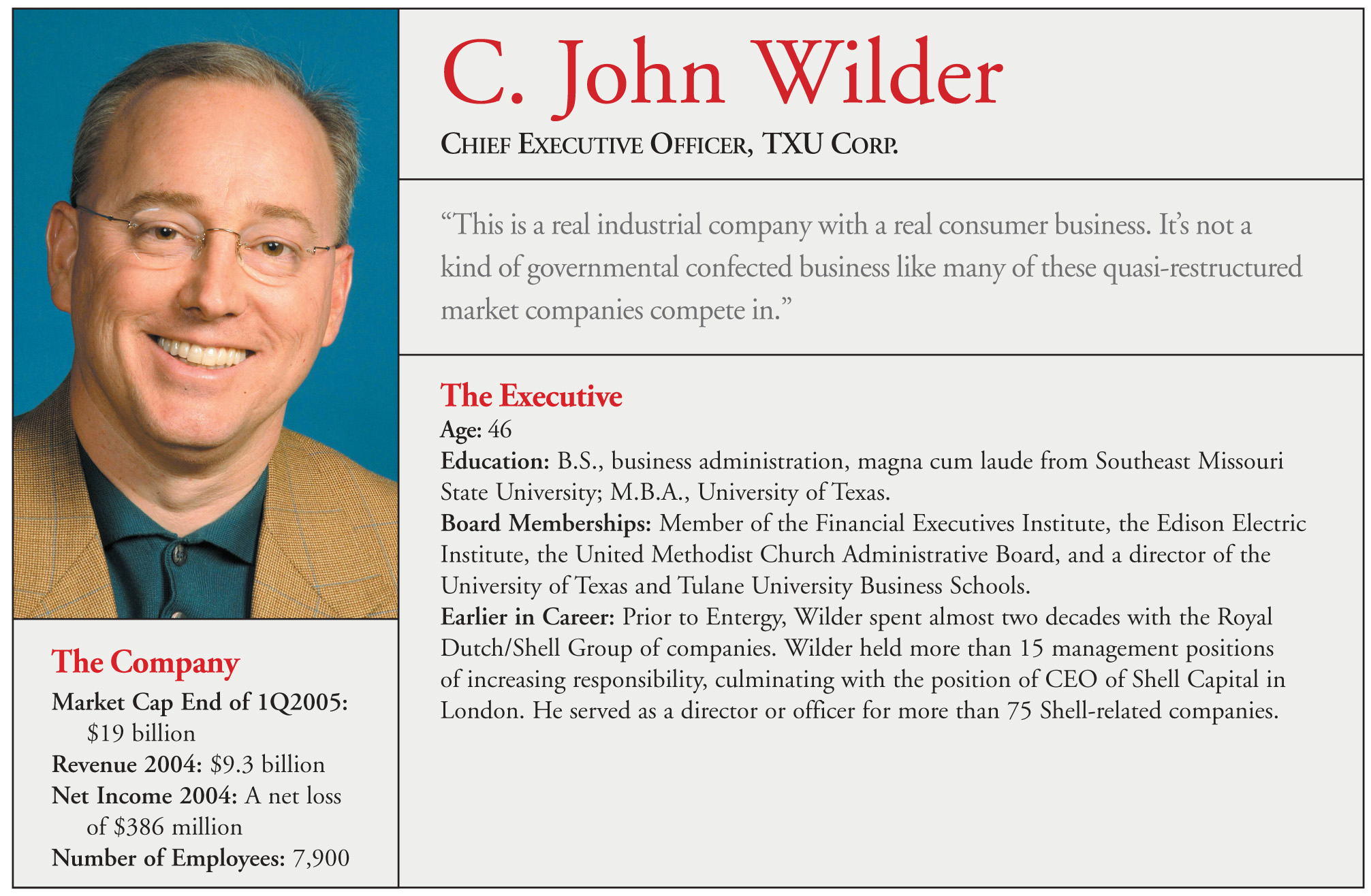

C. John Wilder

Chief Executive Officer, TXU Corp.

"This is a real industrial company with a real consumer business. It's not a kind of governmental confected business like many of these quasi-restructured market companies compete in."

Public Utilities Fortnightly How would you say your company distinguishes itself from its peers? What businesses provide the most promise?

John Wilder For TXU, we are clearly a unique animal, a unique company, in the sense that we are the largest competitive company by, frankly, an order of magnitude in the utility space. We are a $20-billion market-cap company with-it depends on how you calculate it-with at least three quarters of that value coming from unregulated operations. We are the largest competitive retailer in the United States by a factor of 30, 40, 50 percent, [again] depending on how you calculate it. We have about 2 million truly competitive retail customers. These are customers that have real choice, not like many of these others confected markets that have been designed over the last dozen or so years that really don't drive real competition at the retail level. We have had customer switching rates in our market that are about 10- or 15-fold what these other markets have experienced. This is a real industrial company with a real consumer business. It's not a kind of governmental confected business like many of these quasi-restructured market companies compete in. This is a real market economy in Texas. That is what distinguishes us. We're moving down the path and have made, frankly, very good progress in running TXU, particularly TXU's manufacturing business, as an industrial company by trying to achieve operational excellence and cost leadership. We get the benefit of that to the extent that we can run our manufacturing complex at high performance levels. And if we don't run them at high performance levels, we get punished for that economically. Almost all the other companies that your readers read about don't have that same economic incentive or disincentive. And, as I mention, on the consumer business, we have customers that have real choice. There are 80 competitors in our market that are fighting for the same valued customers we are fighting for. So, that just introduces an entirely new dynamic and one that we believe distinguishes our company.

Fortnightly Your company has placed much emphasis on succeeding in the Texas competitive market. But with more than 2.5 million customers, what kind of growth do you hope to achieve from this business?

Wilder The great benefit that we have is the economy in which we compete. There was a recent report that came out from the Texas state demographer indicating that Texas is projected to be the fourth largest growing state in terms of population in percentage terms, and the largest in absolute terms. The market in which we compete, the Dallas-Ft. Worth area, is expected to double in size in the next 20 some years.

If you look at North American Electric Reliability Council (NERC) regions … the ERCOT market in which we compete has the highest growth rate of any NERC region in the country. We can grow our business like Florida can grow their business, which has slightly higher growth rates, just by virtue of new customer growth. This year alone we'll probably hook up 50,000 new houses. These are different kind of homes that have been built in the past. They're not all mansions. Home sizes are getting larger. Home cooling needs are getting larger. And electrical needs are getting larger because of swimming pools and various amenities people are building in. We can grow our business organically by virtue of the market that we can compete.

We also believe we grow our business around some of these core businesses that we have. We are a top quartile operator from an operating performance and cost performance in coal-plant operations. We have plants in place to drive that operation to a top operator. We believe we can grow our business nationally around coal plant operations, and maybe even gas plant operations. We have made a very small entry step outside our core territory or market [into the Southern Texas or Houston-Corpus Christi area]. We stumbled a bit when we entered into that realm. The year before last we lost about $100 million dollars in those markets. Last year we lost $50 [million] and this year we think we'll make about $20 million or so. We believe we can grow that business over the next three to five years in to a $100 million business.

Fortnightly Is the growth rate in Texas higher than the average growth rate in other states?

Wilder If you look at the average growth rate … [most] companies have from a half-percent to one percent growth rate per year. We have this really great incumbent position in a high-growth market, which is very valuable. The growth rate in Texas is about two-and-one-half to three-and-one-half percent.

Fortnightly Will TXU ever compete in other competitive markets?

Wilder We hope to. None of the markets today are constructed in a way that make them competitive. That's why there has been no switching. Most of these markets you look across there have been no more than a 1 to 2 percent switch rate. In Texas there has been a 75 percent switch rate for industrial customers, 50 percent switch rate for commercial customers, and about a 20 percent switch rate for residential customers. So, there is just no market that compares in terms of the real competitiveness of the market. So, if you look out near the end of the decade and you get some of these big markets like Pennsylvania, New York, Illinois, Ohio, they might unfold in a way that would enable a strong retailer of the consumer electricity product, and that's what we believe we are today. … It might enable a market opportunity in those markets. But right now we don't have any plans because the economic incentives just aren't attractive. The contribution margin that you can earn in those businesses because of the way the rate mechanisms are established just don't invite competition.

Fortnightly Natural gas prices have been extremely high throughout the country, particularly in Texas. Is there a market or legislative answer? What has been the impact of high gas prices to your business?

Wilder Natural-gas prices since the market opened have increased a couple hundred percent. Natural gas prices are the predominant price-setting commodity for electricity in Texas. It's difficult to market a product to a consumer when the underlying product pricing has been under some substantial inflationary pressure. The customer is not supposed to understand why we can't find more hydrocarbons in the ground and in North America. Or why there are drilling constraints in Alaska. Or why the geological structures 10,000 years ago didn't put more natural gas under the ground of the United States, but put five-fold of that under Brunei. Those are the kinds of issues that the consumer never can understand. But the reality is not that they are not smart enough, it is just that there is no reason that they should invest in an understanding of that. The consequence is that they have to pay more for their natural-gas product and their electricity product as a result. So, to be retailing that product to them in that escalating cost environment does offer up some challenges in the legislative framework because politicians like to look for easy answers. And there is not an easy answer to the long-term energy needs of the Unites States of America. … We have gone decades with under-investing in energy infrastructure across the entire business system. From refineries to oil and gas fields, to gathering systems to gas processing plants. You kind of name it, and there have not been adequate market signals and adequate reinvestment opportunities for industry participants to invest. It's going to take us at least a decade if there are adequate price signals, which today there seems to be in almost all of the key commodity lines to get the infrastructure back in productive shape…

Fortnightly TXU undertook in the last year one of the biggest business process outsourcing (BPO) deals in the industry with consultants Capgemini. Has the relationship and the projected savings performed to plan?

Wilder It is going really positive and good. What we didn't have at TXU, if you look at the basic performance level, our back office performed very poorly by any performance standard that we were able to apply to it. To take it a step further, [the back office] was performing poorly-high cost, poor service-and it was hurting us in the marketplace. Our phone answer time was 300 seconds when I got here. It's now sub-15 [seconds] on almost any given day. Many days we drive it down to a two- to three-second answer time. Those are clearly best in the industry and are best when you go across other industries like telephone.

What happens when [customers] get poor service and they call a utility and get the interactive voice response and it is hard to get through, or the customer service agent isn't friendly, or it takes 45 seconds to 60 seconds to answer the phone? Where does a customer go? Nowhere. It's a monopoly. We don't enjoy that here. We have to fight for every customer that we have. So, we had to transform our back office to be a competitive weapon for our consumer retail business. The way you transform a back office is through technology. We aren't good, we weren't good, and are not still that good at how to really employ technologies to provide better service to your customer. So, we needed a technology partner. We actually examined doing it on our own. What if we get a big technology implementation plan? We go through and try to refresh all of our technologies in a way that they are more customer services orientated to make us more productive. We thought the execution risk of that was just too high. It was much better to shift that execution risk over to a professional business processing outsourcer and a technology implementer. Let them absorb that risk. We would get the benefit of that risk transfer through lower contract. It lowered our operating expenses by about $200 million per year. So, it almost took 40 percent of our operating costs out of the back office and this is the real bonus, and dramatically improved the service to our customers. So, this is no way to look at that business transformation as anything other than a stunning success.

Fortnightly How do you benchmark Capgemini's performance to manage the effectiveness of your relationship?

Wilder Before we started that venture, we had a half-a-dozen measures across all of our back office. Today we have about 350 measures of which about 125 measures Capgemini actually gets paid on. Our measures range from customer service satisfaction to error rate on bills, to our collection periods on our accounts receivable, to our internal transaction inter-speed for our employees calling to find out the balance of the 401K account … just a wide variety of performance metrics that we monitor and work with Capgemini Energy and monitor on a monthly, weekly, and daily basis, and they actually get their compensation based on both the employees as well as the compensation for Cap Gemini Energy [the entity managing TXU's BPO]. … The contract is set for 10 years.

Fortnightly In the last year, TXU had been considering the novel step of outsourcing its energy trading and risk-management function to investment bank Credit Suisse First Boston. What made TXU change its mind? What did you hope to save, and what were the risks?

Wilder We still like the idea. It is kind of a good idea. … It was really a kind of competition for commodity trading talent. We were going into the [deal] to try to upgrade our management capability in that area. We thought a venture with a financial services partner would give us the right cache in the marketplace to attract and retain high-quality talent, because fundamentally commodity trading is a talent gain. We interviewed people for management of the [new trading] company, for CEO of the company, and interviewed some of the potential key participants. And it just kind of died of its own weight. The cost structure was going to be four or five times what we thought it was going to be. We were hoping to set the enterprise up in Dallas, but the demands among the talent were, no, "Let's set it up in the New York area."

That wouldn't be a big deal to us, but it kind of bothered us a little bit. We thought wait a minute we're not trying to set up a hedge fund up. The reality is that that is what most of these managers wanted. They wanted our capital and access to our information flows on how commodities trade, and they just wanted to trade the commodities like a hedge fund. To be frank, that's where they can get the most economic gain personally. A good commodity trader can make a lot of money working for a hedge fund. It was one of those ideas that is a neat idea. I still think it is a good idea, but the market opportunity probably wasn't right. We had a lot of other things going on in the company that we needed to execute. It looked like it wasn't going to get there. It was one of these exercises where the view isn't worth the climb. And we backed off.

Fortnightly Given your company's involvement in competitive markets, what direction do you think policy is headed and what have you learned from your experience in Texas? What could have been done better in overall competitive markets and in Texas?

Wilder I think overall policy development, particularly competitive markets, will be slow. It takes a long time for people to get the memories of Enron and rolling blackouts in California out of their mind. We are mindful in Texas that we are the model in the United States, meaning that if Texas works it could lead to a much more broad scale and much more rapid restructuring of the market in the United States. That is just the reality. We are a very large reality, the largest power consuming state in the country, equivalent to a Great Britain in size. So, this is a big power market. Globally, we rank in the top 15 or so. It is quite high. If we were a country on our own we’d be the fifteenth largest electricity consuming country in the world. If we get this thing right and it works—I think it’s not a boastful statement to make, it’s factual—that if this works and it drives innovation and new investment and new efficiency, I think other states will catch on…The arch enemy of utilities is always the industrial customer. The industrial customer generally finds it offensive that the utility doesn’t have to be efficient, that they can pass on all their costs regardless of the bozo decisions that they make, etc. It just bothers them. Of course, the utility is offended at the industrial customer because they are so demanding and ruthless in terms of their demands of performance, and they believe they oversimplify the manufacturing of electricity. The typical industrial customer will think, well, anyone can run a chemical plant, steel mill, or auto plant. That’s a complicated manufacturing complex to operate, what you do isn’t very hard and you should be able to do it a lot more efficiently. So, there’s a history in the industry for those two classes of market participants to be at odds. That’s been the way it’s been in Texas. It’s gone back decades.

Category (Actual):